Individuals and organizations alike seek multiple ways to save money. Corporations, for instance, achieve savings by issuing bonds. But how? Borrowing from banks typically comes with higher interest rates, making bonds an economically attractive alternative for them.

Mutual funds that allocate a minimum of 80% of their assets to corporate bonds are commonly referred to as corporate bond funds. To learn more, continue reading!

Corporate Bond Funds: Definition & Meaning

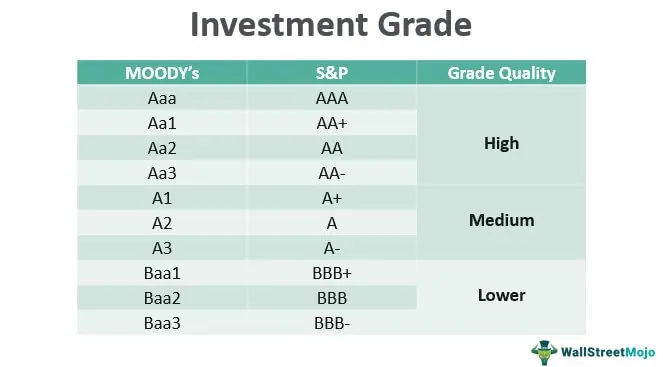

According to the Securities and Exchange Board of India (SEBI), a corporate bond fund is an open-ended debt scheme that invests at least 80% of its assets in corporate bonds. These funds typically focus on investing in corporate bonds with high credit ratings, generally rated AA+ and above.

What Are Corporate Bonds? Corporate bonds are debt instruments issued by companies to raise capital for various purposes, including maintaining cash flows, building credit ratings, and funding capital expansion.

They have gained popularity as a means for companies to raise necessary funds and for investors to earn income through interest payments.

[Also Explore: Types of Debt Mutual Funds]

Examples Of Corporate Bond Funds

Here are some examples of corporate bond fund schemes with their respective past performances. Note- This list does not consist of any financial advice.

| Fund Name | 3-Year CAGR | 5-Year CAGR |

| Nippon India Corporate Bond Fund | 5.93% | 7.16% |

| ICICI Prudential Corporate Bond Fund | 5.86% | 7.68% |

| Axis Corporate Debt Fund | 5.60% | 7.23% |

| Aditya BSL Corporate Debt Fund | 5.47% | 7.67% |

| HDFC Corporate Bond Fund | 5.43% | 7.76% |

Features Of Corporate Bond Funds

What features make these funds attractive to investors? Let’s discuss.

1. Decent Returns

Investors have a plethora of investment options, which is why companies must provide decent returns to attract them. Corporate bonds offer higher returns compared to other debt instruments.

2. Good Liquidity

The open-ended nature is an important feature of these funds. It allows investors to buy or sell fund units anytime without incurring any charges.

[Also Explore: Liquid Funds]

3. Security of Capital

Corporate bond funds invest in highly rated bonds, which results in very low risk and ensures capital protection. This characteristic makes corporate bond funds a suitable choice for risk-averse investors.

4. Diversification

Instead of investing all your money in a single bond, these funds offer you the opportunity to diversify your portfolio by investing in bonds from multiple companies.

Risks & Returns

Since these funds invest in companies with high credit ratings, the chance of default is low. However, unlike other debt funds, they also carry some degree of risk.

In general, corporate bonds are considered riskier than government bonds. In contrast, corporate bonds promise higher returns than government bonds, sometimes even twice as much.

[Related: GILT Funds]

RETURNS: Corporate bond mutual funds in India have averaged 7.08% annual returns in the last year. The 3 and 5-year annualized returns are 4.89% and 7.19%, respectively.

Important Points

Let’s discuss some important key points to consider before investing in corporate bond funds.

- Consider your financial goals and investment horizon

- Compare different funds against the benchmark

- Pay attention to the past performances of funds

- Avoid newly launched fund schemes

- Be aware of the expense ratio and exit loads

[ This May Help: How To Select A Mutual Fund ]

FAQs

Can I do SIPs in corporate bond funds?

Yes, investors can easily choose to invest in corporate bond funds through SIPs.

How are corporate bond funds taxed?

Corporate bond funds are debt-oriented funds. According to the revised taxation rules, short-term & long-term capital gains on debt funds are taxable under the applicable tax slab.

How to invest in corporate bond funds?

You can follow these steps to invest in corporate bond funds:

A. Register with any reputed online investment platform

B. Open an account & complete KYC

C. Select A Corporate Bond Fund

D. Choose the mode of investment i.e. lumpsum or SIP Investment

E. Make the payment